Southwestern Conference - July 2007

Southwestern Conference - July 2007

August 3, 2007

The attendance at this year’s Southwestern Fertilizer Conference in San Antonio was just a few registrants short of the previous record in spite of our industry’s dramatic ongoing consolidation.

This is a reflection no doubt of the fact that most participants in the fertilizer supply chain have just completed a good, and in many cases, an exceptional fertilizer year. Reminiscing “old-timers” favorably compared this past season to the spring of ’74; another boomer but a much more difficult environment.

Here are some additional reflections on what we heard in shadows of the Alamo:

• The farm economy is strong - there will be a generally supportive Farm Bill passed, and the Biofuel Boom will continue. The belief is that growers will continue to be strong buyers of crop nutrients going forward.

• From a supply perspective, consolidation has significantly strengthened the position of North American Potash and Phosphate producers, enabling them to exert unprecedented market power. The only rule that you will need to remember for the foreseeable future is that they set the rules...

• North American Nitrogen producers are also well positioned. They are sheltered in significant measures from offshore competitors who must navigate a long, complex and expensive distribution pipeline. It would appear that currently low feedstock costs are also allowing domestic producers to adjust prices to selectively discourage imports.

• Although nitrogen prices are seasonally soft, producers are not concerned. Prices are still trading within a very high range, and domestic inventories are low. Most bins and tanks bottomed-out at some point during what turned out to be an extended spring season. Several of the large Canadian nitrogen plants have already gone down, or will do so shortly, for extensive turnarounds that will tighten supply further.

• Price risk remains our industry’s biggest unresolved dilemma. Having put some money in their pockets, retailers are now anxious to keep at least some of it. Buying is therefore tepid, but it will happen.

• Traders are also lurking in the tall reeds waiting for their moment as well. With thin liquidity and long supply lines, the opportunity exists for a few players to aggressively start buying barges; squeezing the market.

• The third calendar quarter is traditionally a buyers’ market internationally. India has been featured in the trade press recently as they have worked over Russian, Middle Eastern, and Chinese urea suppliers through a rotation of tenders. Eventually though, European and Latin American buyers will come back to compete with the North Americans for international supply. It is only a matter of time.

• Current ammonia prices offer the best nitrogen value available, but ammonia has a growing list of related transportation, security, and safety challenges. We could try to further develop a metaphor for this mature product, but we are afraid that it would quickly get us into trouble with the Political Correctness Police.

• Finally, it is important to note that we started the last fertilizer year with a significant overhang. This year we are starting with little inventory, but potentially similar demand. While repeating last year’s profitability might not be possible, we will nonetheless in our view have an opportunity to earn a decent paycheck again this year.

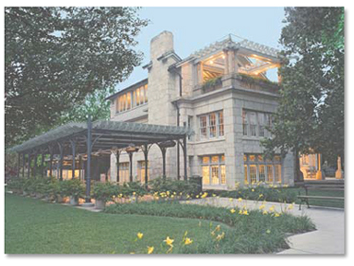

As we have mentioned before, there is a lot of great food in San Antonio. One of our absolute favorite breakfast spots in the world is the Guenther House.

From what we can tell it has not been “discovered” yet, at least by the fertilizer industry, although we have been going there for years.

It opens everyday at 7:00 AM. They don’t take reservations, but it is always empty early. Parking is free and the place is cheap!